Table of Contents

Introduction

In today’s digital age, securing your financial information is more crucial than ever. One of the simplest yet most effective ways to protect your credit card transactions is by setting up a robust PIN (Personal Identification Number). This guide will walk you through the various methods available to generate a PIN for your SBI credit card, ensuring your transactions are safe and secure.

What is an SBI Credit Card PIN?

Definition and Purpose

A Personal Identification Number (PIN) is a four-digit code used to authenticate transactions made with your SBI credit card. Think of it as a digital lock that only you have the key to.

Why a PIN is Necessary

A PIN provides an additional layer of security, ensuring that even if your card is lost or stolen, unauthorized users cannot easily access your funds. It’s an essential part of your financial security toolkit.

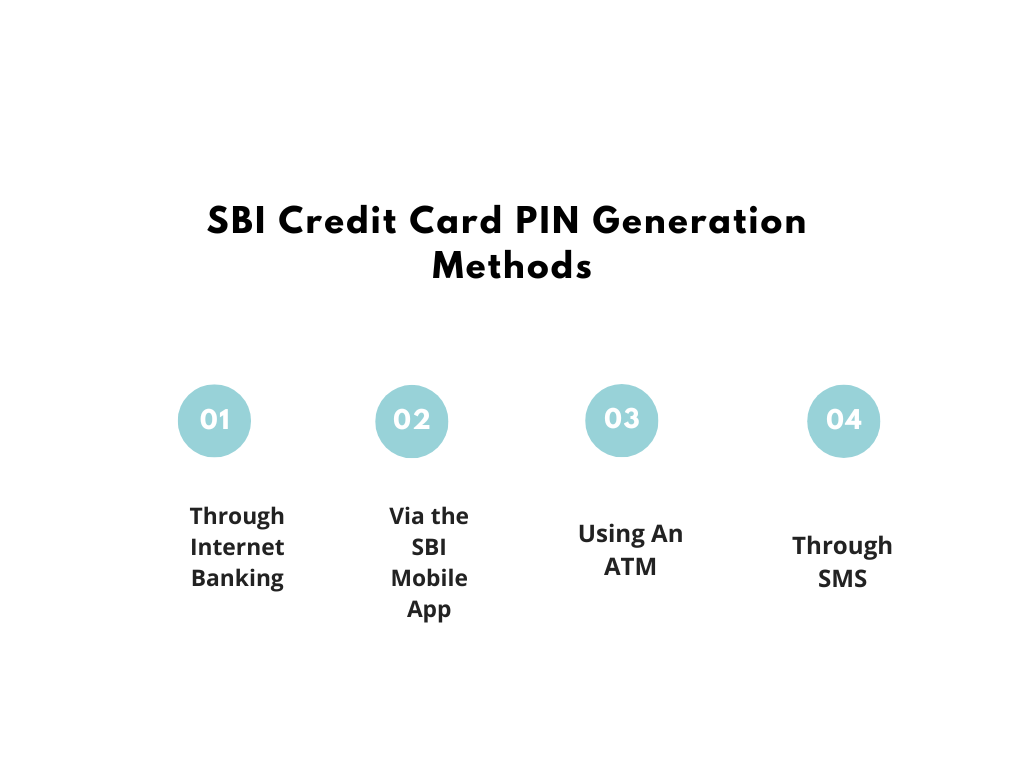

Methods to SBI Credit Card PIN Generation

SBI offers several convenient methods to generate your credit card PIN, allowing you to choose the one that best suits your needs:

- Through Internet Banking

- Via the SBI Mobile App

- Using an ATM

- Through SMS

1. Generating PIN through Internet Banking

Step-by-Step Process

- Log in to your SBI internet banking account.

- Navigate to the ‘Credit Cards’ section.

- Select ‘PIN Generation’.

- Enter your credit card details and follow the prompts to set your new PIN.

Always ensure you’re using a secure internet connection. Avoid public Wi-Fi and use two-factor authentication where possible.

2. Generating SBI Credit PIN via SBI Mobile App

Downloading and Installing the App

First, download the SBI Card mobile app from the Google Play Store or Apple App Store and install it on your smartphone.

Detailed Steps to Generate the PIN

- Open the SBI Card app and log in with your credentials.

- Navigate to the ‘Credit Card’ section.

- Select ‘PIN Generation’.

- Follow the on-screen instructions to set your new PIN.

3. Generating PIN Using an ATM

Locating an SBI ATM

Find the nearest SBI ATM using the SBI ATM locator tool available on the SBI website or mobile app.

Step-by-Step Guide

- Insert your SBI credit card into the ATM.

- Choose ‘PIN Generation’ from the menu.

- Enter the necessary details and set your new PIN.

4. Generating PIN through SMS

Required Details

Ensure you have your registered mobile number and credit card details handy.

Step-by-Step Instructions

- Send an SMS to the designated SBI number in the format: PIN <space> last four digits of your credit card <space> last four digits of your account number.

- You will receive an OTP (One-Time Password) on your registered mobile number.

- Use the OTP to set your new PIN via the SBI ATM or internet banking.

Common Issues and Troubleshooting

Forgotten PIN: If you forget your PIN, you can reset it using any of the above methods. Just follow the steps as if you are generating a new PIN.

Technical Glitches: If you face any technical issues, contact SBI customer support for assistance.

Tips for Setting a Secure PIN

Dos and Don’ts

Do: Use a combination of numbers that are not easily guessable.

Don’t: Avoid using easily identifiable numbers such as your birthdate or sequential numbers.

Best Practices

1)Change your PIN regularly.

2)Do not share your PIN with anyone.

3)Memorize your PIN instead of writing it down.

Changing Your SBI Credit Card PIN

Why and When to Change Your PIN

Changing your PIN periodically can help prevent unauthorized access. It’s advisable to change your PIN if you suspect it has been compromised or every few months as a precaution.

Steps to Change PIN

Follow the same steps as generating a new PIN using any of the available methods.

What to Do If You Suspect Fraud

Immediate Actions

1)Block your card immediately through the SBI Card app or by calling customer service.

2)Monitor your account for any unauthorized transactions.

Contacting SBI Customer Service

Reach out to SBI customer support to report the fraud and get assistance on further steps.

The Importance of Regularly Updating Your PIN

Security Benefits

Regularly updating your PIN helps protect against fraud and unauthorized access, ensuring your transactions remain secure.

How Often to Update

Consider updating your PIN every three to six months or immediately if you suspect any suspicious activity.

Securing your SBI credit card with a strong PIN is a critical step in protecting your financial transactions. Whether you prefer using internet banking, the SBI mobile app, an ATM, or SMS, the process is straightforward and essential for maintaining the safety of your account. Regularly updating your PIN and following best practices will further enhance your card’s security.

1. What should I do if I forget my SBI credit card PIN?

If you forget your PIN, you can regenerate it using any of the methods mentioned: online banking, mobile app, SMS, or at an ATM.

Do I need my registered mobile number for generating the PIN?

Yes, having your registered mobile number is crucial for verification purposes, especially when using the IVR system and online methods.

Are there any charges for generating or resetting my SBI Credit Card PIN?

No, SBI does not charge any fee for generating or resetting your credit card PIN using any of the mentioned methods.

Can I change my SBI Credit Card PIN multiple times?

Yes, you can change your SBI Credit Card PIN as many times as you want using the above methods.