Table of Contents

Introduction

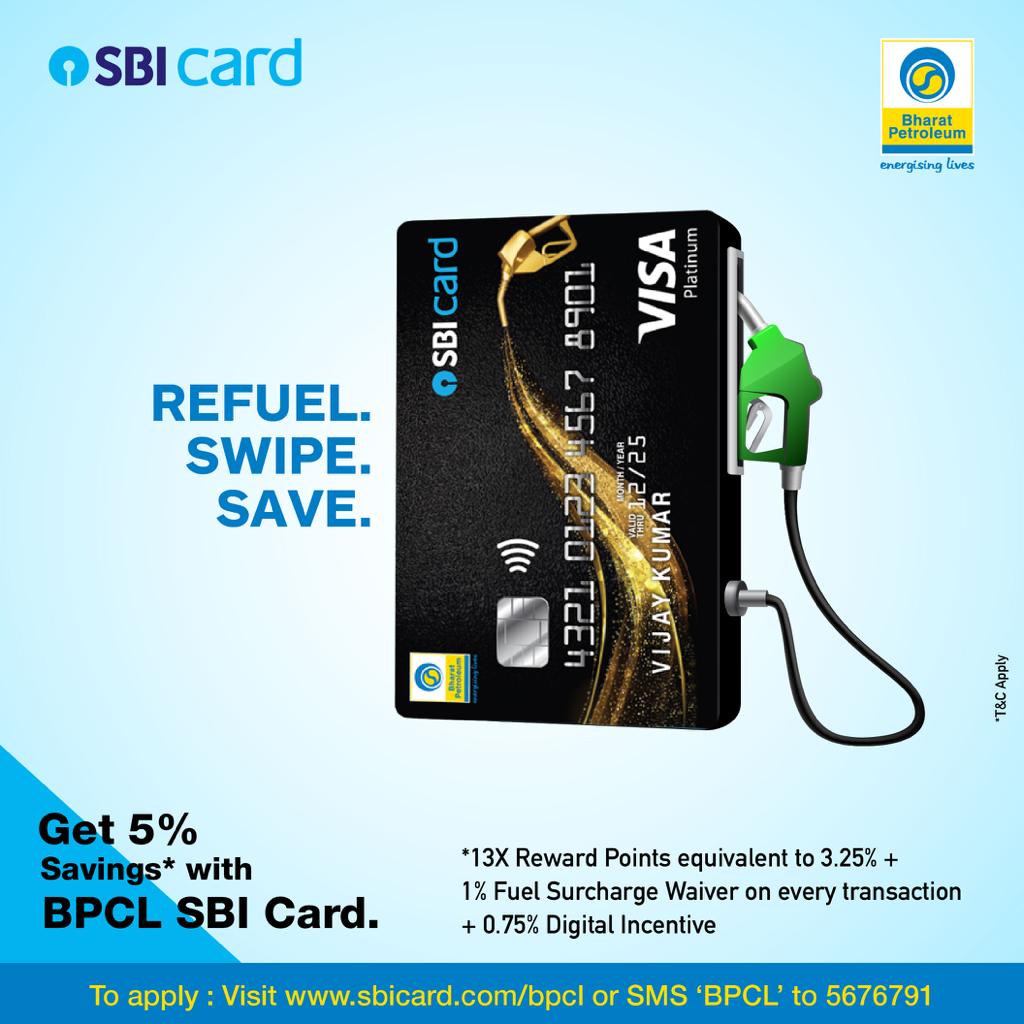

Credit cards have become essential tools in managing day-to-day finances, offering convenience, rewards, and financial flexibility. One card that stands out for those who spend significantly on fuel is the BPCL SBI Credit Card(“Bharat Petroleum Corporation Limited State Bank of India Credit Card.“). This card offers a range of features tailored to maximize savings on fuel purchases, making it an excellent choice for frequent drivers.

Features of BPCL SBI Credit Card

Fuel Surcharge Waiver

One of the standout features of the BPCL SBI Credit Card is the fuel surcharge waiver. Cardholders can enjoy a 1% waiver on fuel surcharges when refueling at BPCL petrol pumps, leading to substantial savings over time.

Reward Points on Fuel Purchases

The card offers an attractive reward points system. For every Rs. 100 spent on fuel at BPCL outlets, cardholders earn 13 reward points. These points can be accumulated and redeemed for various benefits, including free fuel.

Easy Bill Payments

Managing utility bills is easier with the BPCL SBI Credit Card. Users can set up automatic bill payments, ensuring they never miss a due date and avoid late fees.

Contactless Payments

The card is equipped with contactless payment technology, allowing for quick and secure transactions. Simply tap the card at compatible terminals for hassle-free payments.

Benefits of Using BPCL SBI Credit Card

Savings on Fuel Expenses

With the fuel surcharge waiver and reward points on fuel purchases, cardholders can significantly reduce their fuel expenses. This makes the BPCL SBI Credit Card a cost-effective choice for those who drive frequently.

Access to Exclusive Offers

Cardholders have access to exclusive deals and discounts across various categories, including travel, dining, and shopping. These offers provide additional value beyond fuel savings.

Wide Acceptance

The BPCL SBI Credit Card is accepted at millions of merchant locations worldwide. This extensive acceptance ensures that cardholders can use their card for a variety of purchases, both domestically and internationally.

Enhanced Security Features

Security is a top priority with the BPCL SBI Credit Card. It comes with an EMV chip, which provides enhanced protection against fraud. Additionally, the card offers zero liability on lost cards, ensuring peace of mind for cardholders.

How to Apply for BPCL SBI Credit Card

Eligibility Criteria

To apply for the BPCL SBI Credit Card, applicants must meet certain eligibility criteria, including a minimum age requirement and a stable source of income.

- 21-65 years.

- Income Range: Rs.25,000+

- CIBIL score should be 730+

Application Process

The application process is straightforward. Prospective cardholders can apply online through the SBI Card website or visit a nearby SBI branch. The online application form requires personal and financial information.

Required Documentation

Applicants need to submit proof of identity, address, and income. Commonly accepted documents include Aadhar card, PAN card, passport, utility bills, and salary slips.

Approval Timeline

Once the application is submitted, SBI typically processes and approves the application within a few days, provided all documents are in order.

Reward Points System

Earning Reward Points

The BPCL SBI Credit Card rewards users generously for fuel purchases. For every Rs. 100 spent at BPCL petrol pumps, cardholders earn 13 reward points. Additionally, they can earn reward points on other categories like dining and groceries.

Redeeming Reward Points

Reward points can be redeemed for various benefits, including free fuel, gift vouchers, and merchandise. The redemption process is simple and can be done online through the SBI Card website.

Special Reward Point Offers

From time to time, SBI offers special promotions where cardholders can earn additional reward points on specific transactions. Keeping an eye out for these offers can maximize benefits.

Expiry of Reward Points

It’s important to note that reward points have an expiry date. Cardholders should redeem their points before they expire to make the most of their benefits.

Fees and Charges

Joining Fees

The BPCL SBI Credit Card comes with a joining fee of Rs.499.

Annual Fees

The BPCL SBI Credit Card comes with an annual fee (starts from Rs.499), which is waived if the annual spending exceeds a certain threshold(>1,00,000 spendings). No annual fee from 2nd year onwards.

Interest Rates

Interest rates on the BPCL SBI Credit Card are competitive. However, to avoid interest charges, it is advisable to pay the full outstanding amount each month.

Late Payment Charges

Late payment charges are applicable if the minimum payment is not made by the due date. It’s important to stay on top of payments to avoid these fees.

Other Miscellaneous Fees

Other fees include cash advance fees, over-limit charges, and foreign transaction fees. Cardholders should familiarize themselves with these to avoid unexpected costs.

Comparison with Other Fuel Credit Cards

Key Differences

When compared to other fuel credit cards, the BPCL SBI Credit Card offers superior reward points for fuel purchases and a competitive fuel surcharge waiver.

Pros and Cons

Pros

- High reward points on fuel purchase

- Fuel surcharge waiver

- Wide acceptance

Cons

- Annual fee

- Reward points have an expiry date

Why BPCL SBI Credit Card Stands Out

The BPCL SBI Credit Card stands out for its robust rewards program and comprehensive benefits tailored specifically for those who spend significantly on fuel.

Security Features

- The EMV chip in the BPCL SBI Credit Card offers enhanced security against fraud, making transactions more secure.

- The card is equipped with advanced fraud detection systems that monitor transactions for suspicious activity, providing additional protection.

- In case of a lost or stolen card, cardholders have zero liability for unauthorized transactions if they report the loss promptly.

- The BPCL SBI Credit Card ensures secure online transactions with OTP verification and other security measures.

Customer Support

- SBI offers a 24/7 helpline for cardholders to address any queries or issues related to their BPCL SBI Credit Card.

- Cardholders can also access online support through the SBI Card website, where they can manage their account, make payments, and check reward points.

- SBI provides a robust grievance redressal mechanism to address any complaints or concerns cardholders may have.

- In case of a lost or damaged card, SBI offers a straightforward card replacement process to ensure minimal disruption to the cardholder.

Additional Benefits

- Cardholders can enjoy complimentary access to airport lounges, enhancing their travel experience.

- The BPCL SBI Credit Card offers exclusive discounts on dining and shopping, providing additional value to cardholders.10X reward points on Dine-in, Grocery & Movie.

- Cardholders can convert their purchases into easy EMIs, making it easier to manage large expenses. Convert purchases above Rs.2500 into EMI using Flexipay.

- The card offers insurance coverage for lost cards and unauthorized transactions, providing peace of mind to cardholders.

FAQ’s

1)Which SBI credit card is best for petrol pump?

SBI BPCL Credit Card.

2)What is the maximum limit per month for SBI BPCL credit card?

Maximum limit in a month is Rs 10,000 per account.

3)Can I withdraw money from my SBI BPCL credit card?

As an BPCL SBI Cardholder, you can withdraw cash from over 1 million VISA/RuPay ATMs across the globe, including 18,000 ATMs in India.

4)What is the cibil score for SBI credit card?

A minimum CIBIL score of 730+ is necessary to get your SBI credit card approved.